In a Pinch? MoMa makes Money Management a Cinch!

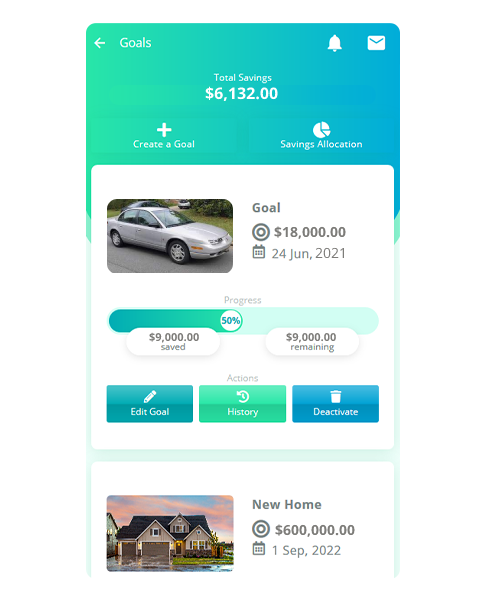

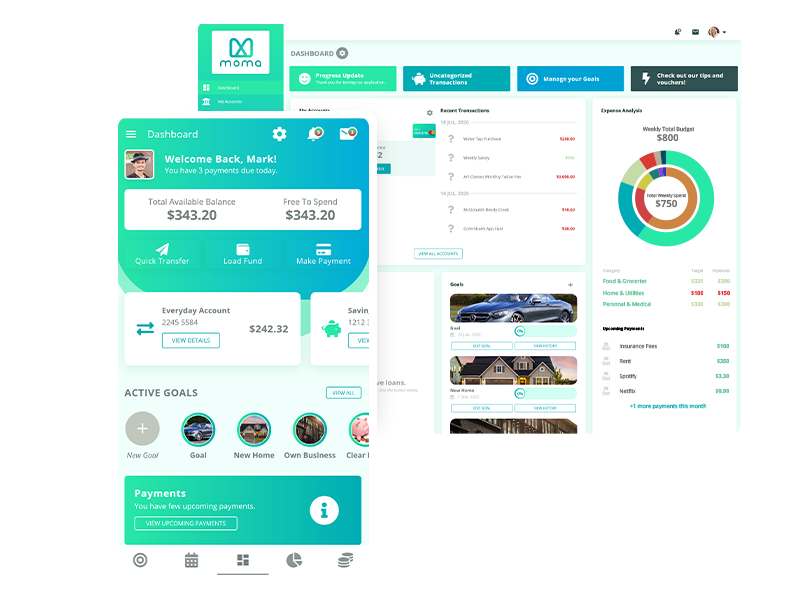

MoMa integrates with nearly every Australian transaction bank account, to allow a personalised user interface which puts you in the driver's seat. Set your own goals, rid yourself of debt and see your progress along the way.

Take control of your finances! MoMa is more than just numbers on a screen…

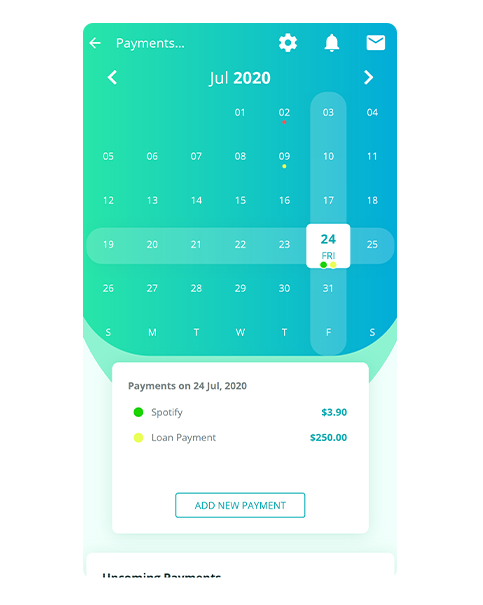

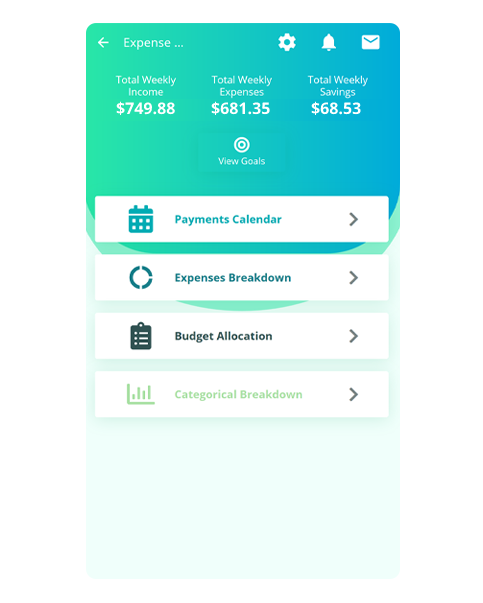

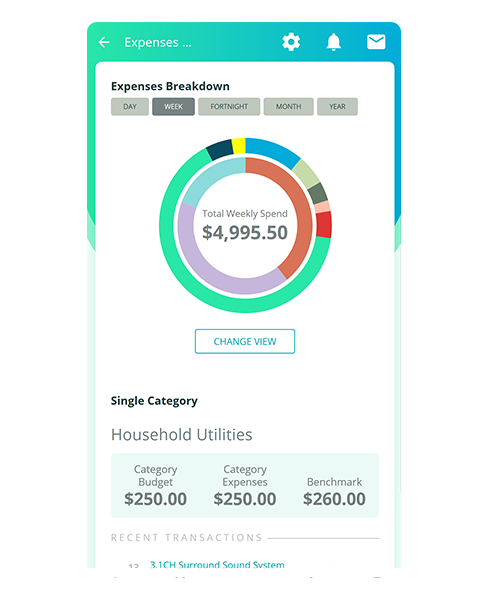

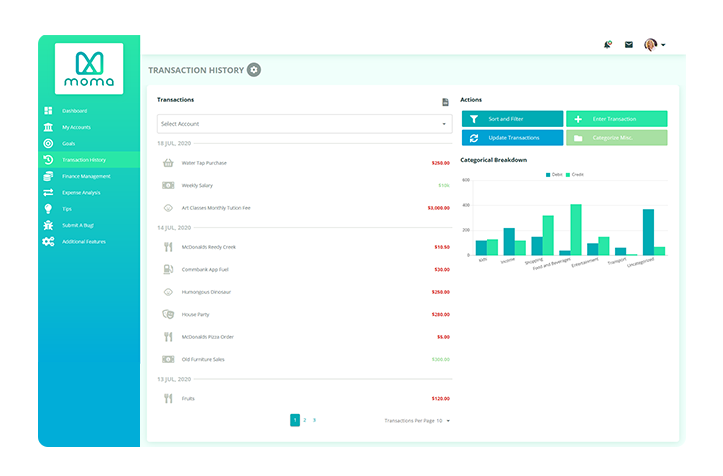

Track spending. Budget simply. Save to meet your goals. The MoMa app is free to download and easy-to-use! Financial insight, expense analysis – MoMa shows you where your money is going and allows you to manage your spend better. With notifications and reminders, you’ll never forget an upcoming bill again!

Managing money made easy!

MoMa provides you with an easy to use tool to assist in achieving your financial objectives, whatever they may be. We are more than just a budgeting app, we are a complete Money Managing platform that assist everyday Australians achieve financial freedom.

How does it Work?

Download MoMa

MoMa is available on the App Store & Google Play.

Sign Up

MoMa populates your financial information without hassle.

Save Money

MoMa gets to work so you can focus on the day-to-day.

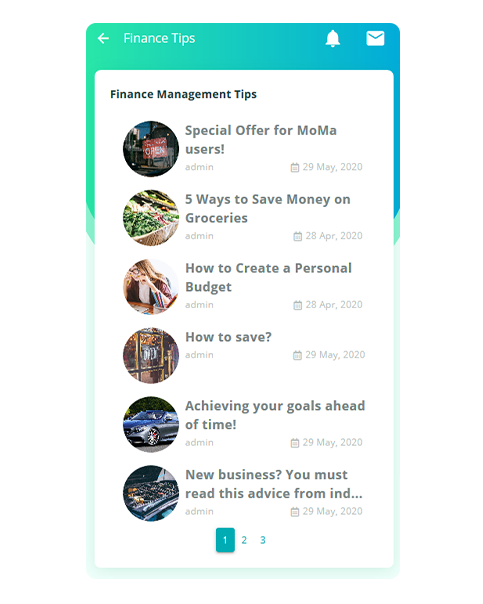

From the blog

How to Achieve New Financial Goals

Now is the perfect time to pay a great deal of attention to an important area in your finances — achieving new goals. Creating and sticking to a new financial plan can be the single best thing that you do this year. With the help of a budget, it will force you to take a … Continued

Read more

Ways to Up your Skill to Up your Salary

Many people avoid talking to colleagues about their salary or what they earn. However, how would you know if you’re getting paid what you’re worth? Learn how to negotiate to get what you deserve by reading these tips on how to up your salary. Do market research about salary You have to know your value … Continued

Read more

How to Afford your Dream Wedding on a Budget

Making your dream wedding come true can be expensive. An average Australian wedding costs around $36,000. According to a survey by Moneysmart, 82% of groom and bride used their savings to pay for their wedding. Another 60% got a personal loan and 18% used their line of credit. Worst case scenario is debt will follow … Continued

Read more